Auto Insurance Report - Oct 2025 Salvato Feature

We are proud to have Auto Insurance Report share more about what we're doing at Salvato Auctions and how we are a smarter option for salvage insurance vehicles.

Reprinted with Permission Of The Publisher (October 27, 2025 - Vol 33#9/1544)

Startup Swimming With Whales In Auto Salvage Auction Waters

The thousands of acres that salvage auction operators Copart and IAA have collected over decades to store vehicles have long been seen as an insurmountable moat protecting the duopoly from new competitors.

But a startup believes that decentralizing vehicle storage itself provides a path over that obstacle. The company, Salvato, sees its approach as the logical next step in an evolution that began when the industry eliminated in-person auctions years ago.

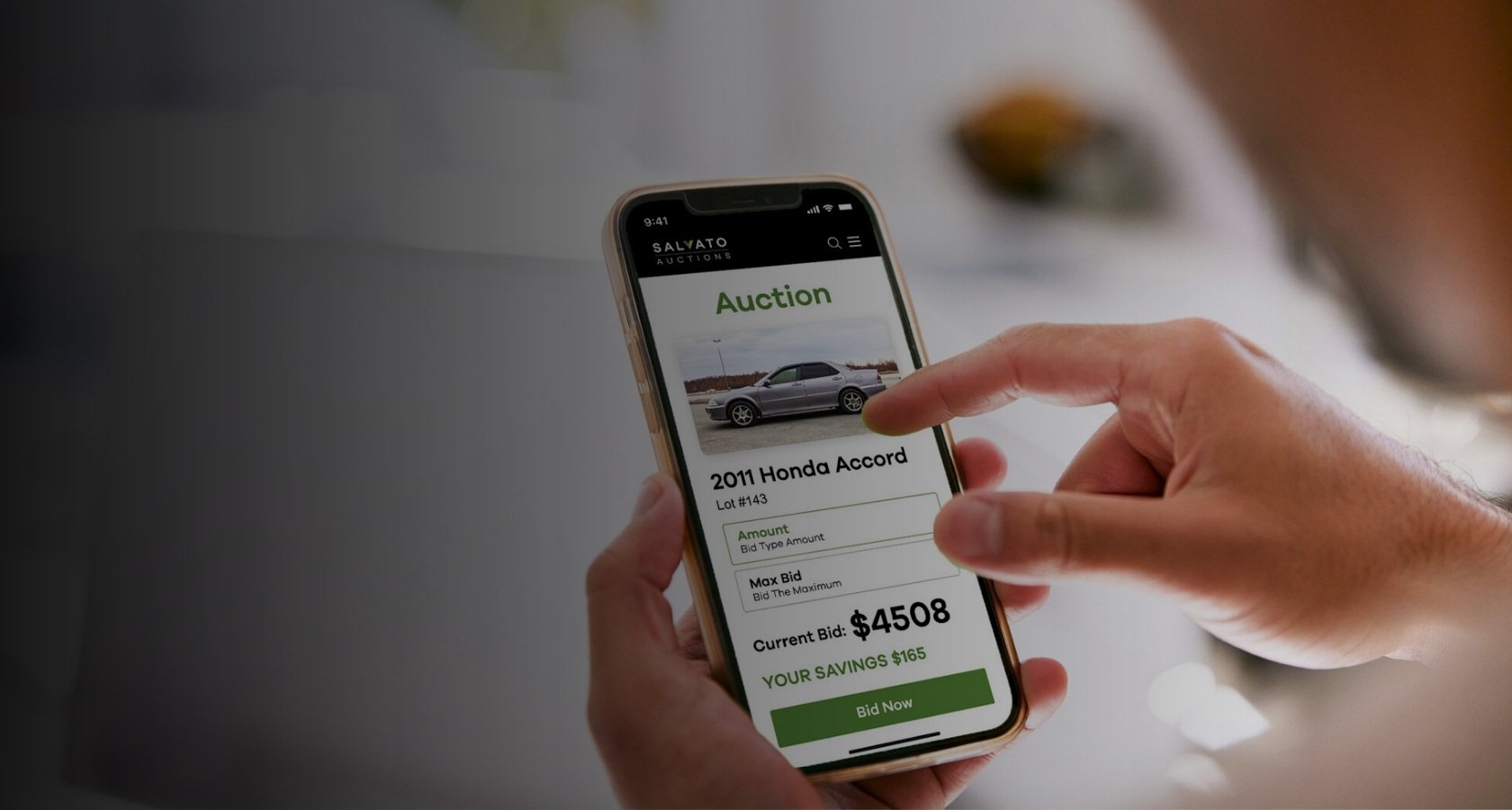

Salvato is launching online salvage vehicle auctions with a strategy to cut fees and cycle times by selling cars directly from towing company lots, rather than moving them to huge storage facilities like those largely owned by Copart and mostly leased by IAA.

Salvato opened its first online auctions in Texas in August, selling cars from small insurers in the state. The company has recruited a growing list of more than 30 towing companies in Texas to collect and store totaled cars from body shops or other storage lots until they sell online.

The business expects to sharply improve cycle times, reducing the number of days cars sit waiting to enter auction by using digital titles issued by the new National Digital Title Clearinghouse in West Virginia. The clearinghouse creates digital titles that allow cars from any state to be retitled as salvage and sold legally across the country or overseas, saving weeks of processing time required with paper titles. (AIR 8/11/25)

Salvato will need to move fast to convince skeptics who view vast landholdings as a necessity, and Salvato acknowledges that even with its commitment to a decentralized model it will likely need some parcels near strategic metropolitan areas down the road.

Salvato initially convinced small and midsize carriers to assign their totaled cars to its platform, and it is now pitching larger carriers, which would fuel an expansion into more states. Salvato promises to move the vehicles more quickly, charge lower fees and attract enough buyers to bring insurers a better net return on each car. The net salvage return is the auction value minus fees and any towing charges accrued at the scene of the accident or the body shop before the car was assigned to the salvage auction operator. Ultimately, Salvato will have to deliver the critical mass of both sellers and buyers to create enough action to satisfy both parties.

The company’s co-founders, CEO Peter Jebson and Chief Technology Officer Serhii Bilous, have assembled an experienced team from the salvage world, including former IAA executives Dan Oscarson, John Bean and Tawna Kuni.

Oscarson is building the international vehicle buyer base to bid on the cars, and Bean is recruiting towing partners to move and hold vehicles until they are sold. Towing companies also use Salvato’s browser-based mobile app to upload photos of the cars for sale. Kuni, who joined the company last month, is managing processes and delivery for its current and new insurance customers.

Jebson is leading the sales effort to insurance companies. He previously worked as director of strategy and development at claims technology vendor CCC and as a consultant for national parts recycler Aesop Auto Parts.

Jebson aims to expand Salvato into about a half-dozen more states next year, picking markets where its insurance company customers already do business.

Bilous, who previously worked as lead engineer on JP Morgan Chase’s large commercial payments products, built Salvato’s software and technology platforms. Before that, he worked for Auto.RIA, the largest marketplace for new and used cars in Ukraine. In his spare time, Bilous built a platform for Ukrainian buyers to connect with brokers who buy salvage vehicles from Copart and IAA on their behalf.

Attracted by the emphasis on speed, a Texas auto insurer assigned half of its totaled cars to Salvato’s auction platform while continuing to send the other half to its traditional salvage auction operator. Over time, the company will evaluate Salvato’s results to see if the expected improvement to net return and cycle times materialize.

“We’re looking for smart ways to be more efficient,” the company’s claims director said. “We’re excited to see what the end result will be.”

The claims director can envision a future in which Salvato’s network of towing companies grows to the point that the insurer’s cars end up on Salvato partner lots directly from accident scenes, without requiring the secondary tow from a shop or other lot before auction.

Salvato’s decentralization strategy for salvage auctions mimics an innovation in the dealer-to-dealer used car market from ACV Auto Auctions and Backlot Cars. Both companies launched in 2015 using a blueprint to enter the used car market and compete with Manheim and Adesa, the leaders in that space.

Like Salvato, the central innovation at ACV and Backlot Cars was decentralization. Both companies sell cars online directly from dealerships, rather than transporting vehicles before auction to giant lots like those owned by Manheim. (Backlot Cars was eventually bought by Adesa’s former parent KAR Global in 2020, which then sold Adesa to Carvana in 2022 and then renamed itself as Openlane.)

Salvato faces an additional obstacle that ACV and Backlot Cars did not have: used cars are already at dealerships following trade-ins, while totaled cars must be collected from a shop or yard after a collision.

Copart and IAA, which is now owned by heavy machinery auction operator RB Global, consolidated the salvage business over decades into a duopoly and led the transition from in-person auctions in gravel lots to global online bidding wars. Copart sells more than 4 million cars annually, and IAA sells more than 2.5 million each year, according to company websites. More than a third of sales now go overseas, where the companies have built physical bidding lounges where brokers help buyers with the basics of online bidding and the logistics of retrieving cars from across the ocean. Most of the cars sold in Copart and IAA auctions were declared a total loss by insurance carriers, but they also sell a mix of fleet, rental cars and other heavily damaged and low-value vehicles from a variety of sources.

Salvato exclusively sells cars declared total losses by insurance companies. The company says this provides more confidence to buyers that the cars have not been stripped of valuable parts before sale, which can happen to abandoned vehicles or cars with unknown ownership history that sometimes find their way to auction.

Oscarson spent 34 years at IAA, where he helped develop the company’s international buyer base, before spending a year in Dubai at Marhaba Auctions as chief operating officer. He is recruiting domestic parts recyclers and rebuilders to bid on Salvato cars while calling broker contacts overseas to establish the bidding competition needed to achieve high enough auction values for carriers.

“The biggest challenge with buyers is changing their behavior,” Oscarson said. “People have been doing it the same way for a long time.”

Salvato is integrated into the two bidding software platforms used by most parts recyclers, Bid Buddy and BidCall Direct. The very largest auto recyclers like LKQ use their own bidding software. Jebson and Oscarson said that LKQ is currently bidding on Salvato auctions manually through the website, but if the volume of cars available increases, LKQ can integrate Salvato’s inventory with an API to populate cars into its system.

“The API is consumed by not only Bid Buddy and BidCall Direct, but also other buyers and brokers are using it to attract attention on our vehicles everywhere,” Oscarson said. “For example, our cars are listed on a website in Latvia attracting buyers throughout Eastern Europe, and we have a number of additional integrations underway in other domestic and global markets as well.”

The broker relationships overseas are key, he said, because they recruit buyers and direct them to Salvato’s vehicles.

“They know how to communicate,” Oscarson said. “And we provide social media content and other material to help them tell the story and spread our message. It’s truly a global effort. If somebody doesn’t bid in our auction, it’s not because they haven’t heard about it.”

As the two salvage auction giants expanded their reach from North and South America around the globe, they also focused intently on reducing cycle times for insurers by handling titles and paperwork for liens placed on vehicles that have outstanding loans. Despite improvements, transferring paper titles from one state to another can still take weeks and remains one of the biggest drags for carriers and auction operators. IAA, through its subsidiary DDI, is moving toward digital titling, and Copart has pressed for more states to launch their own digital title programs through its participation in the eStart Coalition.

Salvato sees an opportunity in West Virginia’s clearinghouse – which can generate a digital title in hours – to start fresh without any ingrained paper processes.

“There is at least two weeks that we cut just in the turnaround time to get the salvage title back, because the clearinghouse is fully integrated,” Jebson said. “We get it back the same business day, and most states across the U.S. take two to three weeks to turn that around.”

As a startup, Salvato faces two key challenges. Getting the global buyer base to bid on its cars is one challenge, but the larger one is convincing insurers to assign their total loss vehicles to a newcomer, rather than to incumbents with a proven ability to drive salvage values higher by growing international demand.

“There’s a big appetite from the towers and the recyclers to do something different to put more money in their pockets,” Jebson said.

Salvato will also face obvious inventory and efficiency challenges presented by its initial lack of scale – more cars for sale bring more buyers which bring higher values. And while operating central storage lots increases overhead costs for the large incumbents it also creates efficiencies – such as the ability to move multiple cars at once to a single location, rather than towing individual totaled cars for every loss, said analyst Robert Labick, president of the brokerage firm CJS Securities.

Equity analysts say the decentralization strategy could hamper Salvato’s growth.

John Healy, managing director of the equity research firm North Coast Research, points to the real estate purchases made by ACV Auto Auctions as proof that eventually Salvato will need its own lots. Salvage auctions need acreage to both hold vehicles after a catastrophe and to manage storage costs for cars that may be tied up in lengthy litigation or claims investigations, he said.

“I think real estate is a big deal in this business, and it’s difficult for me to get to a point where I think real estate doesn’t matter,” he said. “Maybe there’s a way to do it in a more decentralized manner. It just hasn’t been proven.”

The challenges are not lost on Jebson, who described IAA and Copart metaphorically as naval warships. But he sees business opportunities in maneuvering like a cigarette boat in the same waters.

Copart and IAA have spent decades buying and leasing property, building gigantic real estate portfolios to store cars awaiting auction. Those landholdings form a considerable barrier to entry for any potential competitor, but they also create a baked-in overhead expense that cannot be easily unwound.

“They’ve been super successful companies, growing their revenue a ton and becoming very profitable,” Jebson said. “But in a marketplace business, by definition that revenue comes at the expense of sellers – in this case the insurance company. And at that size and level of success, it’s difficult to disrupt your own business and be willing to put more money back on the table for sellers, where it belongs.”

Jebson said that for the foreseeable future, existing towing company lots can provide plenty of capacity after catastrophes to hold the totaled cars of its insurance customers. Based on industry data, Salvato estimates there is more available storage at towing yards across the country than land owned by Copart or leased by IAA combined.

Still, down the road, the company may acquire some strategic property in certain dense or catastrophe-exposed metro areas. But the model overall will remain decentralized.

“I’d rather go from a blank slate and build a physical footprint only in select markets where it’s needed, rather than try to unwind the cost that’s all built into having so much land,” Jebson said.

Jebson said that Salvato’s model, built comprehensively around speed and low overhead – from the digital titling process to decentralized storage – means that it saves money that it can return to insurers in the form of lower fees. He argues that the incumbents incur significant costs on site regardless of how quickly or slowly a vehicle sells, which reduces the incentives for speed.

Insurers care about speed for both operational and financial reasons – faster cycle times mean higher returns for cars, which lose value the longer they sit.

Carriers say existing cycle times are delayed by titling, but also because it can take days or even weeks to deploy local towing companies to move vehicles from body shops to their central storage facility, which may not be nearby and could result in higher per-mile towing fees.

Salvato’s towing partners in Texas have so far shown capability and willingness to collect the cars quickly and bring them back to their yard, where they can earn new daily income by holding the inventory until the car sells. Bean, head of operations for Salvato, has been crisscrossing Texas recruiting towing companies since January. He has landed more than 30 now and expects to add more.

“There are a lot of these guys that have a lot of space,” said Bean, who was previously senior vice president of centralized operations at IAA. “They just don’t use it. And [we] have a good use for it, and we’re not going to clog it up with a bunch of vehicles … because we move fast.”

Salvato has also made inroads with the network of towing companies, like Mission Wrecker Service, that have government contracts to move and store cars seized by the Internal Revenue Service, Drug Enforcement Administration and other federal agencies.

Mission has a five acre outdoor lot in San Antonio with capacity available for Salvato vehicles, in addition to an indoor storage facility that it typically uses for high-end cars seized by federal agencies.

“It works great for us, because we’re already kind of doing this type of work for government agencies,” said Matt Oliver, operations manager at Mission Wrecker Service. “We’re bringing in cars. We’re taking quality photos of these vehicles, we’re storing them for long periods of time, so we already had the knowledge and the capacity to do this, and the staff on hand to do it with.”

Domestic parts recyclers welcome new entrants in the auction marketplace, given the potential for lower fees in an industry with tight margins and growing competition from foreign and domestic rebuilders.

“Anything, really, that is going to bring down some of those costs is excellent,” said Emil Nusbaum, vice president of government affairs strategy at the Automotive Recyclers Association.

Rising buyers fees at the existing auction companies “certainly have made it more difficult” for recyclers, he said. “But it’s both the fees and the fact that you have a very competitive auction environment,” he added.

Adding to the global demand for salvage, the U.S. rebuilding market has grown in the last 20 years, Nusbaum said. The demand is “just driving up the price of that salvage, which is making the total loss appeal for an insurer even more attractive.”

LINK: Auto Insurance Report

You May Also Like

These Related Stories

How Salvato’s Timed Auction Works and Why It’s Better

Salvato Signs Additional Insurance Carriers Expanding Vehicle Inventory Ahead of August 7 Auction Launch